join us cable A channel to stay up to date with the latest breaking news

In a market where bold moves dictate success, today’s cryptocurrency market displays a dynamic mix of innovation and resilience. With a trading volume of over $742 billion in the past 24 hours, investors are eyeing opportunities amid extreme greed, as shown by the Fear and Greed Index at 77. However, despite the bullish outlook, only 28% of cryptocurrencies showed gains, making Highlights projects that really stand out.

Today, four of the top crypto winners are in the spotlight: Hyperliquid, MANTRA DAO, Raydium, and XDC Network. Each project has blazed a trail using unique technology and market-defining strategies, attracting forward-thinking investors.

Biggest Cryptocurrency Gainers Today – Top List

For the discerning investor, today’s top winners offer more than just short-term highs — they make compelling cases for long-term potential.

Hyperliquid’s gas-free transactions and ultra-fast consensus mechanism, MANTRA DAO’s regulatory-compliant ecosystem, Raydium’s liquidity innovations on Solana, and XDC Network’s trade finance tools are reshaping their respective fields. These projects not only capitalize on the current upward momentum, but also build specific frameworks for sustainable growth.

1. Excess fluid (HYPE)

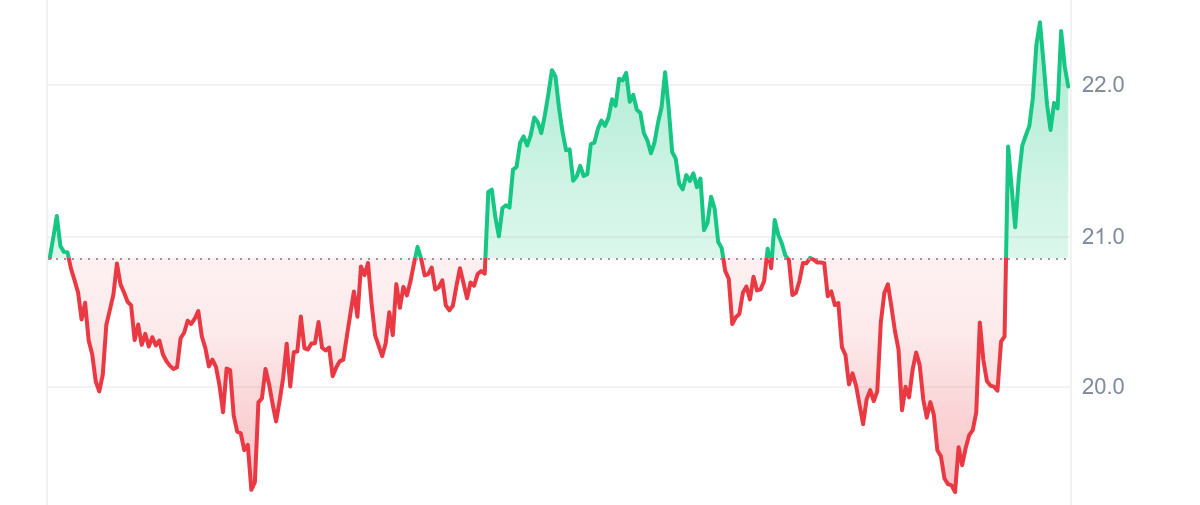

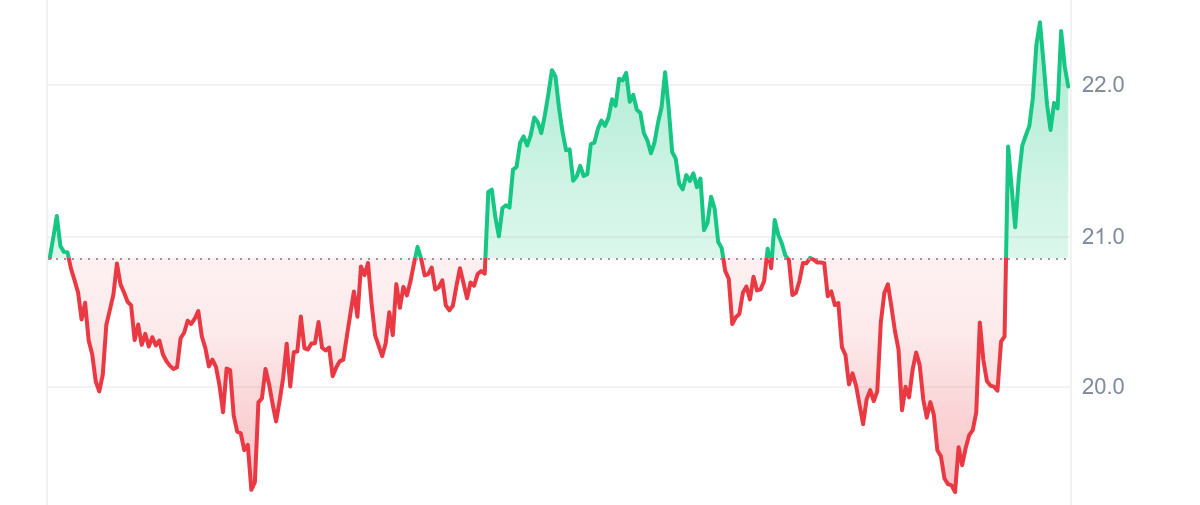

Hyperliquid has caught the market’s attention by rising 7.24% in the past 24 hours, pushing its price to $22.43. As today’s big winner, cutting-edge layer-one blockchain technology continues to redefine decentralized finance by eliminating gas fees and delivering lightning-fast final transactions through the innovative HyperBFT consensus mechanism. Investors were impressed by the fully connected order book, a rarity in the DeFi space that ensures transparency and security.

A notable feature of Hyperliquid is its focus on decentralized trading of perpetual futures, which has gained traction among traders looking for efficiency and low costs. Through a self-funded, independent development model, Hyperliquid reflects a clear commitment to innovation, supported by its team of experts from top organizations and technology giants. This strong foundation strengthens investor confidence and positions HYPE as a major player in the DeFi ecosystem.

Hyperliquid is constantly iterating and improving, all in service of its mission to bring all finance across the chain. The community has played a crucial role in the growth of the ecosystem, and feedback is taken seriously.

Recently, some misconceptions have emerged regarding auditors.

– HyperliquidX (@HyperliquidX) January 8, 2025

Over the past month, Hyperliquid has shown moderate stability, with 16 out of 30 green trading days and a low 30-day volatility of 13%. Its moderate liquidity, indicated by a ratio of 0.0128 of market capitalization to volume, indicates consistent trading interest. These metrics highlight growing market support while maintaining a sustainable price trajectory.

HYPE’s smooth performance and unique features make it particularly attractive to forward-thinking investors who are attracted to transparent and scalable DeFi solutions. As market sentiment remains bullish, Hyperliquid’s combination of innovation and efficiency reinforces its position as a promising investment opportunity.

2. Mantra Dao (OM)

MANTRA DAO has risen by 3.37% in the past 24 hours, attracting the attention of investors looking for reliable and scalable blockchain solutions. As a standout in DeFi, MANTRA prioritizes security and compliance, making it an ideal platform for tokenizing and trading real assets. Built on the Cosmos SDK, it integrates seamlessly with other networks through IBC compliance, providing developers and enterprises with a robust environment for permissioned applications.

With a notable price increase of 5,309% over the past year, MANTRA DAO is trading 59.75% above the 200-day simple moving average of $2.37, indicating a solid long-term performance. Despite this growth, the 14-day RSI of 58.54 indicates a neutral trend, indicating a possible consolidation phase. The platform’s scalability of up to 10,000 TPS and advanced security mechanisms, including a sovereign proof-of-stake verification suite, solidifies its position as a leader in regulatory-compliant blockchain technology.

joins $ohm Lock products and leverage MANTRA Chain’s layer-one ecosystem to tokenize assets in the real world.

More details 👇 https://t.co/cfST6nLcr2

— Binance (@binance) January 16, 2025

Investors with a long-term view will appreciate MANTRA’s ability to outperform 97% of the top 100 crypto assets over the past year. Its balance of innovation and compliance makes it particularly attractive to enterprises and developers navigating Web3 adoption. High liquidity, backed by a 0.0593 volume to market cap ratio, enhances its appeal to active traders.

Given market trends toward real-world asset integration, MANTRA DAO’s comprehensive ecosystem and consistent performance position it as a key player in shaping the future of DeFi.

3. MEMEX Index

The meme coin market has exploded, and is now worth $130 billion, which is amazing $memix He is at the forefront of this revolution. Through the innovative Meme Index platform, $MEMEX provides investors with access to four unique baskets of meme coins. From the stationary Giants to the volatile Frenzy, there’s an option for every risk appetite. The pre-sale is already turning heads, raising an impressive $2,564,059.93 of its goal of $2,870,502. Time is ticking, and there are only 18 hours and 47 minutes left before the next price increase – early action is crucial.

What sets $MEMEX apart is its seamless blend of accessibility and governance. As an owner, you have exclusive access to carefully curated baskets and the power to shape the future of the platform. Investors decide which currencies enter or exit the index, ensuring their relevance and alignment with market trends. This dynamic approach makes $MEMEX a standout option in a saturated market.

The timing couldn’t be better. Meme coins dominate the headlines, and $memix It positions itself as a diversified and safer way to profit from this volatile sector. Instead of betting on individual tokens, investors get broad exposure, reducing risk while retaining significant upside potential.

Pre-sale participants are already reaping the rewards. Through direct staking, early investors can receive an unparalleled 897% annual return while securing their stake in this leading platform. Phased pre-sale pricing adds urgency, rewarding those who act quickly. Don’t miss this.

Visit the Meme Index pre-sale

4. radium (ray)

Raydium captured attention, with its price reaching $7.22, registering a modest 0.12% rise over the past 24 hours. It is known for its innovative approach as an Automated Market Maker (AMM) at Solana. Raydium integrates on-chain liquidity with Serum’s central limit order book, enabling liquidity providers to leverage the ecosystem’s broader order flow and trading opportunities.

Interestingly, the platform recently welcomed FDUSD, a leading stablecoin, to the Solana blockchain. This development enhances Raydium’s utility in DeFi by offering new stable options for custody, pairing, and liquidity. These developments highlight the project’s commitment to expanding its ecosystem, which is in line with its long-term growth strategy.

Market performance reveals a compelling story. RAY has high liquidity, with a volume to market cap ratio of 0.3203, and its price volatility is relatively low at 10% over the past month. Despite an overbought signal from the 14-day RSI of 75.13, Raydium’s impressive 530% annual growth puts it prominently among the best crypto assets, outperforming 92% of its peers.

Investors looking for innovative projects with strong technical foundations may find Raydium attractive. Its impressive 97.92% rise above the 200-day SMA shows strong long-term momentum. While caution is warranted in the short term due to potential corrections, Raydium’s integration of liquidity solutions and expanding ecosystem offers exciting potential for strategic investors.

5. XDC Network (XDC)

XinFin catches the eye today, as its price rose by 0.6% over the past 24 hours to reach $0.130222. Known for transforming trade finance and tokenizing real-world assets, the XDC Network provides a powerful platform for global economic activity. Delegated Proof of Stake (DPoS) ensures fast, scalable and secure transactions, making it a favorite of governments, businesses and financial institutions. With its unique approach, XDC stands out in the crowded blockchain space.

Recently, the launch of the ERC-4337 Shared Mempool on XDC has brought cutting-edge infrastructure to developers. This innovation enables seamless transactions without gas and simplifies the setup process, enhancing user adoption. By connecting with the Ethereum account abstraction ecosystem, XDC is strengthening its position as a leader in cost-effective blockchain solutions. The integration demonstrates its commitment to innovation and scalability, which are key drivers of its market appeal.

🚀ERC-4337 Shared Mempool is now available on @XDC_Network_! 🌐✨

What is a shared Mempool? 🤔

It is a decentralized solution developed through collaboration between @etherspot, @erc4337, @candidelabs And Silius teams that provide greater efficiency and reliability… pic.twitter.com/WLE8TyaBQe

— Etherspot 🐞 (@etherspot) January 15, 2025

In the short term, XDC is showing strong market sentiment with 63% green days over the past month and a neutral RSI at 45.13, indicating potential stability. It is highly liquid, with a volume to market cap ratio of 0.0561, making it an attractive option for investors looking for reliability in volatile markets.

Long-term performance adds another layer of confidence. Trading 167.77% above its 200-day SMA and up 174% over the past year, XDC has outperformed 75% of the top 100 crypto assets. Its steady growth and resilience highlight its potential for both cautious and growth-oriented investors, strengthening its position among today’s investors. Top gainers in crypto.

Read more

Latest ICO Coin Meme – Wall Street Baby

- Audited by Coinsult

- Early access to the pre-sale tour

- Alpha Private Trading for $WEPE Army

- Staking Pool – High dynamic APY

join us cable A channel to stay up to date with the latest breaking news