Shanghai Elliott Wave Composite Analysis Daily Chart

Shanghai Composite Elliott Wave Technical Analysis

Overview of technical analysis

-

job: Uptrend.

-

situation: impulsive.

-

building: Orange wave 3.

-

position: Navy blue wave 3.

-

Direction for the following higher grades: Orange wave 3 (started).

-

details: It appears that Orange Wave 2 has been completed, and Orange Wave 3 is now in progress.

-

Invalid wave cancellation level: 2684.5610.

Analysis overview

Analysis of the Shanghai Composite daily chart confirms the uptrend, based on Elliott Wave principles. The current market situation is classified as impulsive, indicating strong upward momentum. The continuing wave structure, identified as orange wave 3, represents a major phase within a larger uptrend, indicating continued price growth.

The position within the wave sequence is indicated by navy blue wave 3, which indicates the continued advance of the broader upward movement. This stage plays a crucial role in driving the upward trajectory of the market. The development of Orange Wave 3 within this framework highlights the continued strength of the market.

The completion of Orange Wave 2 marks the transition to the next phase, Orange Wave 3, laying the foundation for further potential gains. The trend at the next higher levels continues to support the market’s upward trajectory, enhancing the potential for continued upward momentum.

Key revocation level

The invalidation level was set at 2684.5610, to serve as a crucial reference point. If the price falls below this level, the current wave count will be invalidated, causing the analysis to be re-evaluated. As long as the price remains above this level, the bullish expectations remain valid and intact.

conclusion

In summary, the daily Shanghai Composite chart is showing a strong uptrend, driven by the development of orange wave 3 within the larger navy blue wave 3. The completion of orange wave 2 has laid the foundation for the current upward movement. With the cancellation level at 2684.5610, the bullish outlook remains, and further price increases are expected as the impulsive wave progresses, consolidating the continuation of the broader uptrend.

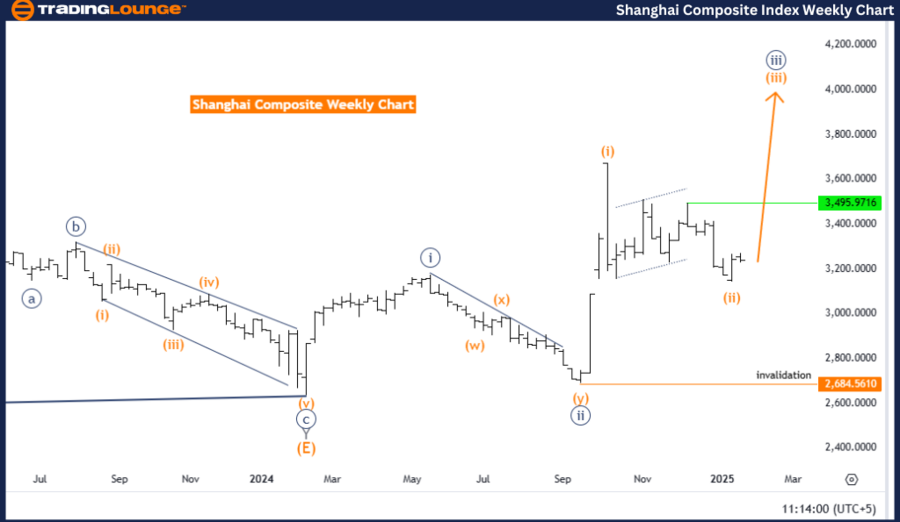

Shanghai Composite Elliott Wave Analysis Weekly Chart for Trading Floor

Shanghai Composite Elliott Wave Technical Analysis

Overview of technical analysis

-

Function: Uptrend.

-

Mode: Impulsive.

-

Structure: Orange Wave 3.

-

Location: Blue Wave Marine 3.

-

Trend following upper grades: orange wave 3 (started).

-

Details: Orange wave 2 appears to have been completed, and orange wave 3 is now in progress.

-

Wave cancellation Invalid level: 2684.5610

Analysis overview

Analysis of the Shanghai Composite weekly chart confirms the uptrend, following Elliott Wave principles. The market is currently in a bullish mode, indicating strong upward momentum. The continuous wave structure, identified as orange wave 3, plays a crucial role in the ongoing upward movement, reflecting the ongoing market strength.

The position within the wave cycle is indicated by navy blue wave 3, representing a critical phase in the consolidation of the overall uptrend. The active development of orange wave 3 within this larger wave structure confirms the continued strength of the market and indicates the potential for further upward advance.

With the completion of orange wave 2, the transition to orange wave 3 has begun, marking the beginning of a major bullish phase. This movement is consistent with the direction of the higher degree wave, which enhances expectations of sustainable price growth as the trend continues to develop.

Key revocation level

The critical invalidation level is set at 2684.5610, which serves as a key criterion for analysis. If the price falls below this limit, the current wave count will be invalidated, necessitating a re-evaluation of the market outlook. However, as long as the price remains above this level, the bullish wave structure remains valid.

conclusion

In summary, analysis of the Shanghai Composite weekly chart highlights a sustained uptrend, driven by the development of Orange Wave 3 within the framework of the larger Navy Blue Wave 3. The successful completion of Orange Wave 2 has paved the way for the current bullish phase, with further gains expected. The cancellation level at 2684.5610 is a critical point to watch, ensuring the current bullish outlook is correct. This wave structure continues to support a strong market, with the potential for further upside momentum.