Analytics firm Glassnode warns that Bitcoin (BTC) is approaching a critical juncture that marked the end of the bull market.

Glassnode says on social media platform

According to Glassnode, historical data He appears Bitcoin tends to enter a bearish zone when its price moves below the value of the scale.

“The Bitcoin Short-Term Holders (STH) cost basis model is crucial for gauging sentiment among new investors. Historically, this model has tracked market lows during bull cycles and has also distinguished bull markets from bear markets.

BTC’s price is now about 7% above STH’s cost basis of $88,135. If the price settles below this level, it can indicate declining sentiment among new investors – which often represents a turning point in market trends.

At the time of writing, Bitcoin is trading at $94,425.

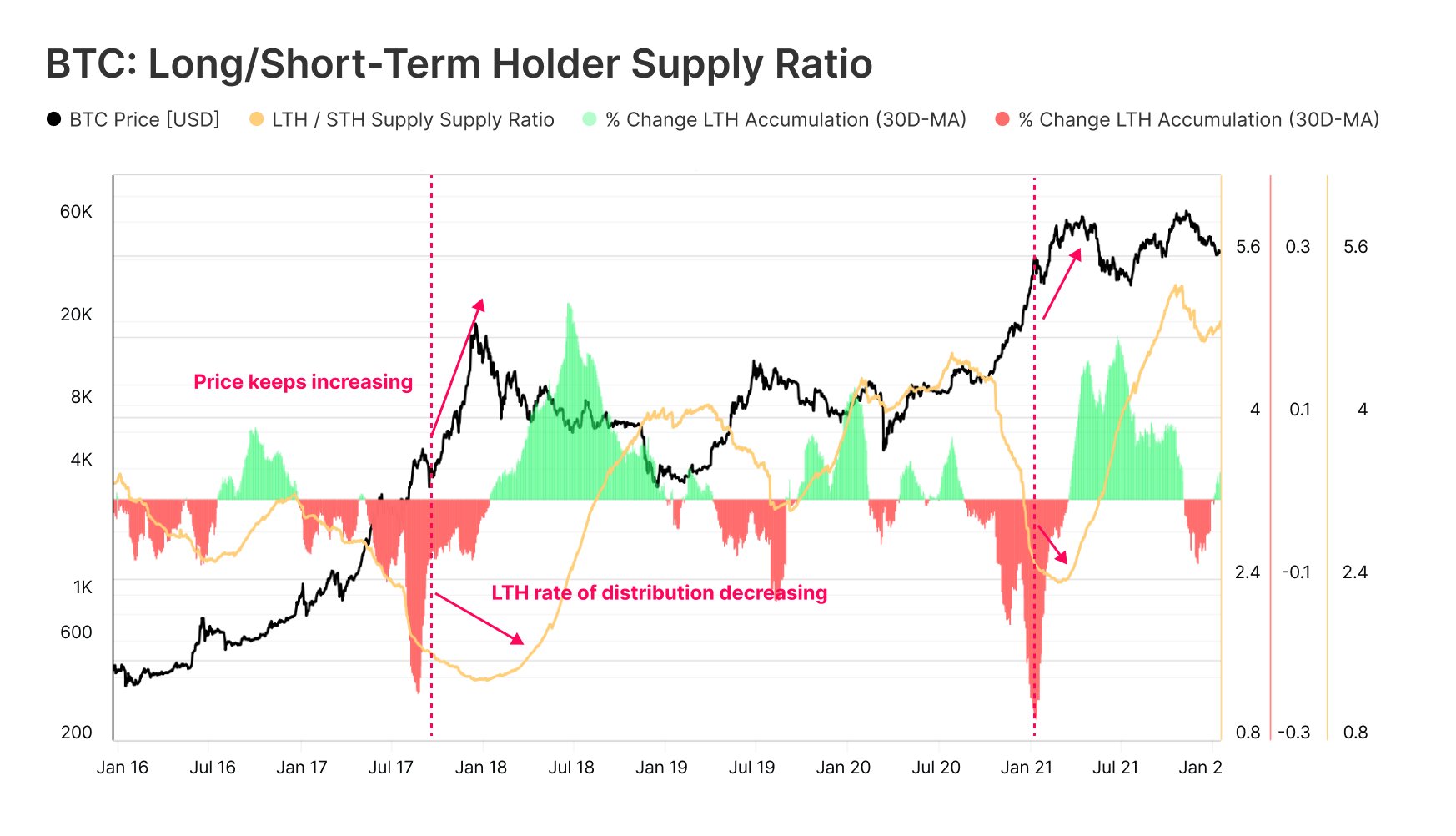

Looking at long-term Bitcoin holders, or investors who have held their Bitcoin for 155 days or more, Glassnode He says The group is offloading its Bitcoin at an extremely fast rate. According to the analytics firm, the extreme distribution for long-term holders does not necessarily indicate that the Bitcoin bull market is over.

“Even at prices about 12% below all-time highs, Bitcoin long-term holders (LTHs) are still distributing, but at a slower rate. However, the 30-day change in LTH supply suggests that the distribution rate has peaked.” Most likely, it has reached the extremes that we witnessed in previous sessions…

In past cycles, prices have continued to rise even after LTH distribution has peaked. This means that the peak of the distribution does not always align with an immediate aggregate peak.

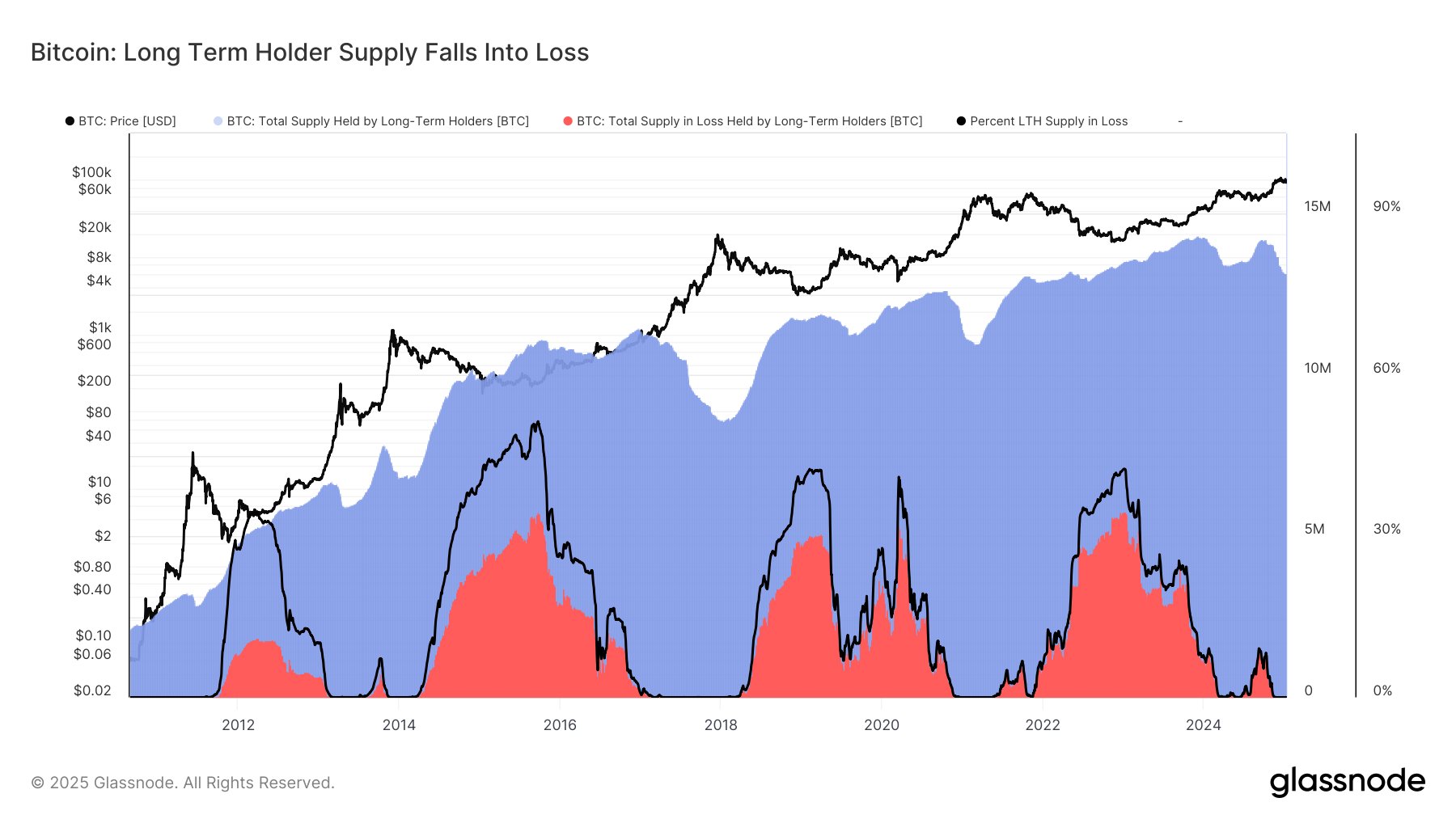

Glassnode concludes its analysis by noting that almost all long-term holders are in the green.

“Another factor to consider: Bitcoin LTH supply remains at a loss at 0%. Almost all long-term holders are still profitable. Historically, when LTHs experience sustained losses that become more severe, it is often the true end of the cycle.” “At the moment, this is not the case.”

Never miss an opportunity – sign up to get email alerts delivered directly to your inbox

Check price action

Follow us on X, Facebook and cable

Browse Hodl’s daily mix

Disclaimer: The opinions expressed in The Daily Hodl are not investment advice. Investors should conduct due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: mid-flight